During periods of National or Global economic uncertainty, small businesses are usually the first to feel the impact because of their micro activities and the direct impact of those activities on the overall economy.

Access to Finance is one of the Major Challenges Small Businesses face and as an access to finance technology platform, Owoafara works closely with financial institutions to provide financing for small businesses.

THE PROBLEM

75% of small businesses who need financing to achieve their next business milestone, do not qualify for access to finance because their business is not currently organized to make them qualified to access financing.

Access to finance becomes even more challenging in uncertain times as these and financial institutions will become choosier in the businesses they offer financing to.

BENEFITS OF THIS TRAINING

Small business owners will know the things to put in place to make their business more profitable.

Help small businesses understand how to position their business to be attractive for financing.

Inform small businesses on what financial institutions and investors look out for in evaluating their business and making a decisions to finance.

Small businesses will understand how Owoafara platform works and how they can increase their chances of being matched and accessing financed on our current and upcoming platform.

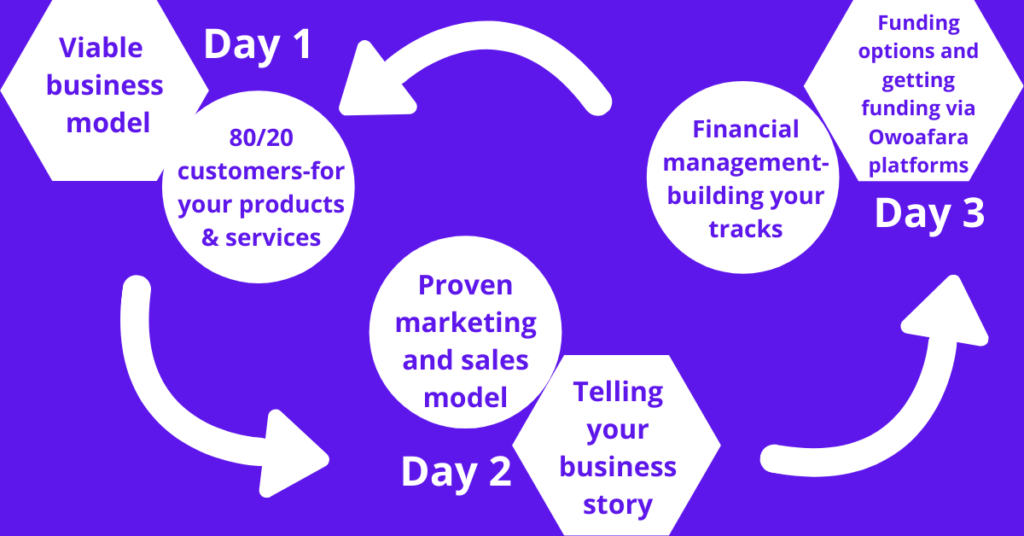

TRAINING CONTENT

Training registration options

OWOAFARA TRAINING TEAM